The slow descent to the holidays continues, but as battle-hardened stock traders we know there is always something out there to profit from, even in the leanest of times. Here are a couple of trades from Wednesday, one of which I did not take for reasons which will become clear…

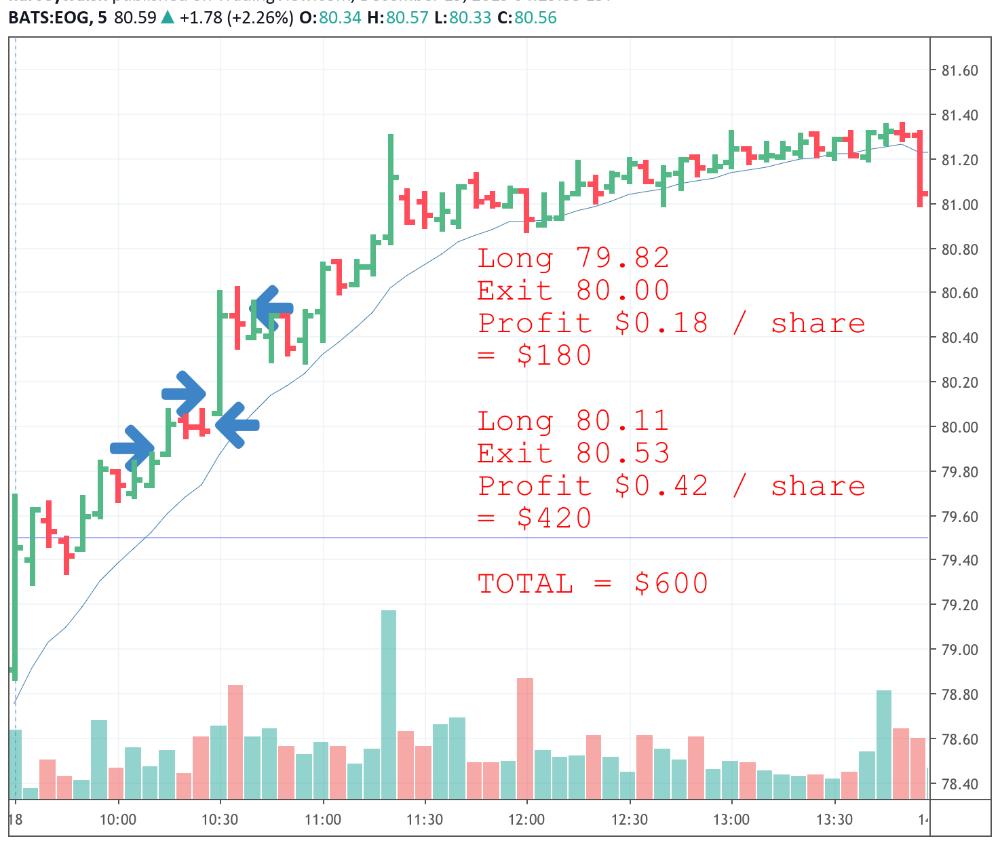

First up, here’s a standard trade on EOG, though it turned into a two-biter for basically the same reason as Monday’s FB trade:

The first move didn’t really go anywhere. Rather than hang around and hope, the strategy says get out without a loss, so a humble 18 cents it was. That paid for the commissions and put a few dollars into the pot, making it easier to risk the second entry.

Momentum was better on the second go, and carried the price a bit higher. Again, the exit came at the first sign of trouble. In these quieter days it’s not always easy to distinguish between the end of a move and a pause for breath, as volumes overall are lower. In the end, there was another good chance to grab even more profit from this one, but I was out by then. $600 wasn’t too shabby all things considered.

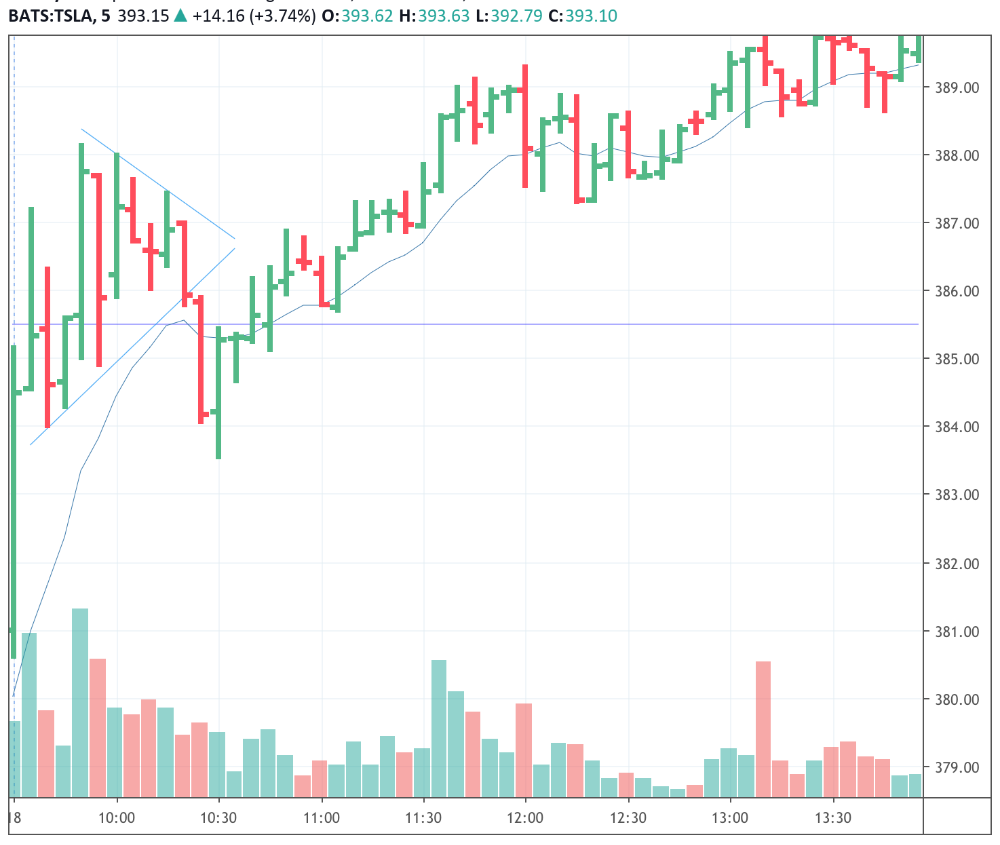

Here’s the one I didn’t trade. I’m posting it because it was a lovely setup and a good example of how keeping things ultra-simple can make for a profitable and low-stress strategy. The opportunity was on TSLA:

This was a nice simple symmetrical triangle. I love triangles, they work brilliantly and they give us a good price target too. This one gave a target of around $3/share, which wasn’t quite hit, but even trading this badly (i.e. letting it go back against us a long way before getting out), it would have been easy to net at least a dollar per share, probably more. On a thousand share position that’s obviously a thousand dollar profit, and the trade would have taken about five minutes.

The other reason I liked this one was because the break of the triangle was followed quickly by a break of the previous day’s high, which is a kind of implicit support/resistance line. A confluence of signals is greater than the sum of its parts, adding confidence to the trade.

Why didn’t I take this trade if it was so great? I wasn’t looking for this setup because trades like this aren’t part of my strategy or trading plan. Had I seen it setting up, I would absolutely have taken it. But I noticed it too late because I wasn’t looking for it.

I know a lot of people say Tesla is too expensive to day trade, and I understand that. But remember we don’t have to trade a thousand shares at a time. With regular margin, this trade could have been taken with a 100 share position with an account balance of $10k, and would have netted at least $100 profit in five minutes. Or it could have been traded as a spreadbet, CFD, etc. There are always ways and means.