There’s no denying that some periods of the year are quieter than others. Even the stock market, which enjoys an unrivaled selection of daily opportunities, shrivels to become a shadow of its normally magnificent self in mid-summer and again around the Christmas holidays.

That’s not to say there’s no opportunity of course. It just means we aren’t overwhelmed with choice. Right now we are in the slow descent to the holidays. It’s at times like these that a good list of core stocks can really help. Especially on days like Mondays when lazy traders like myself don’t want to work too hard looking for easy setups.

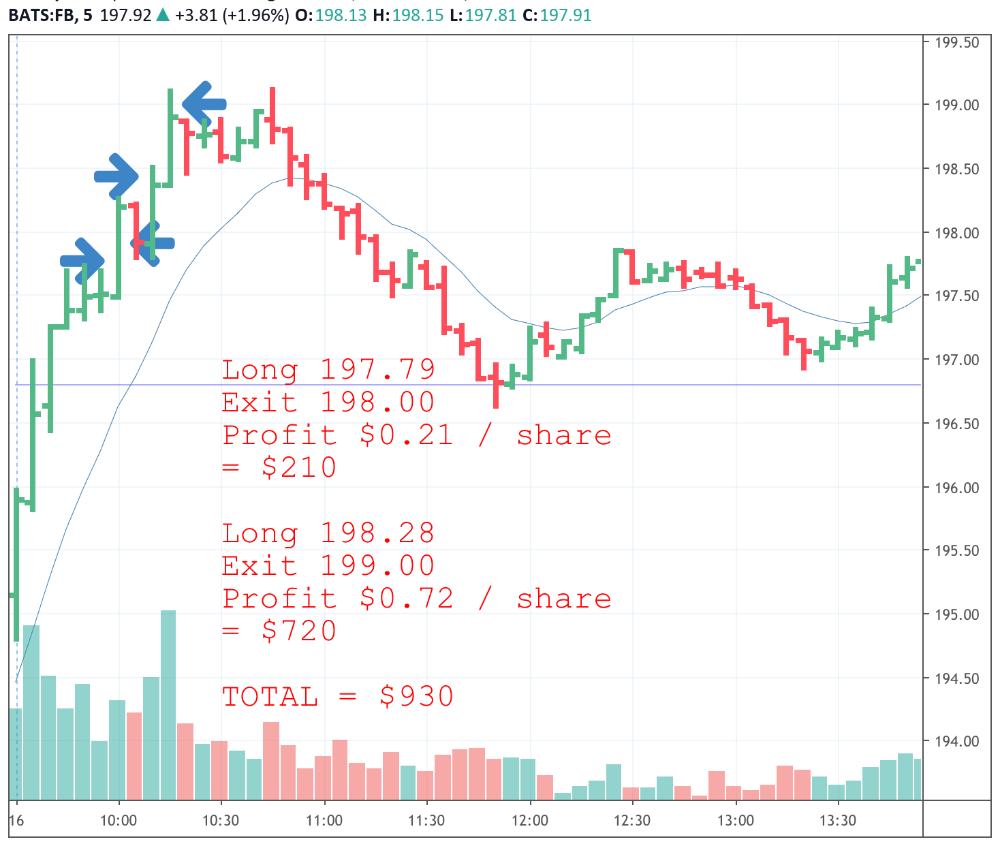

And so it was that this week began with a two-biter on FB. It wasn’t supposed to be a two-biter, but the first bite nearly didn’t work out at all, leading to having to jump out with minimal profit and then have another go. Here’s the chart:

It did look quite promising to start. But as I said, it didn’t work out, momentum failed and there was a bit of a drop. Actually it turns out staying in wouldn’t have led to a loss, but you don’t know that at the hard right edge. All we can do is trade according to what we see and avoid loss.

The second entry was better, but with the magic $200 mark not that far above, there was reason for caution. That combined with the earlier failed entry meant taking a quick exit when things looked wobbly.

All in all, $930 for a couple of trades that were all done by 10:30. And of course, FB wasn’t the only trade of the day.