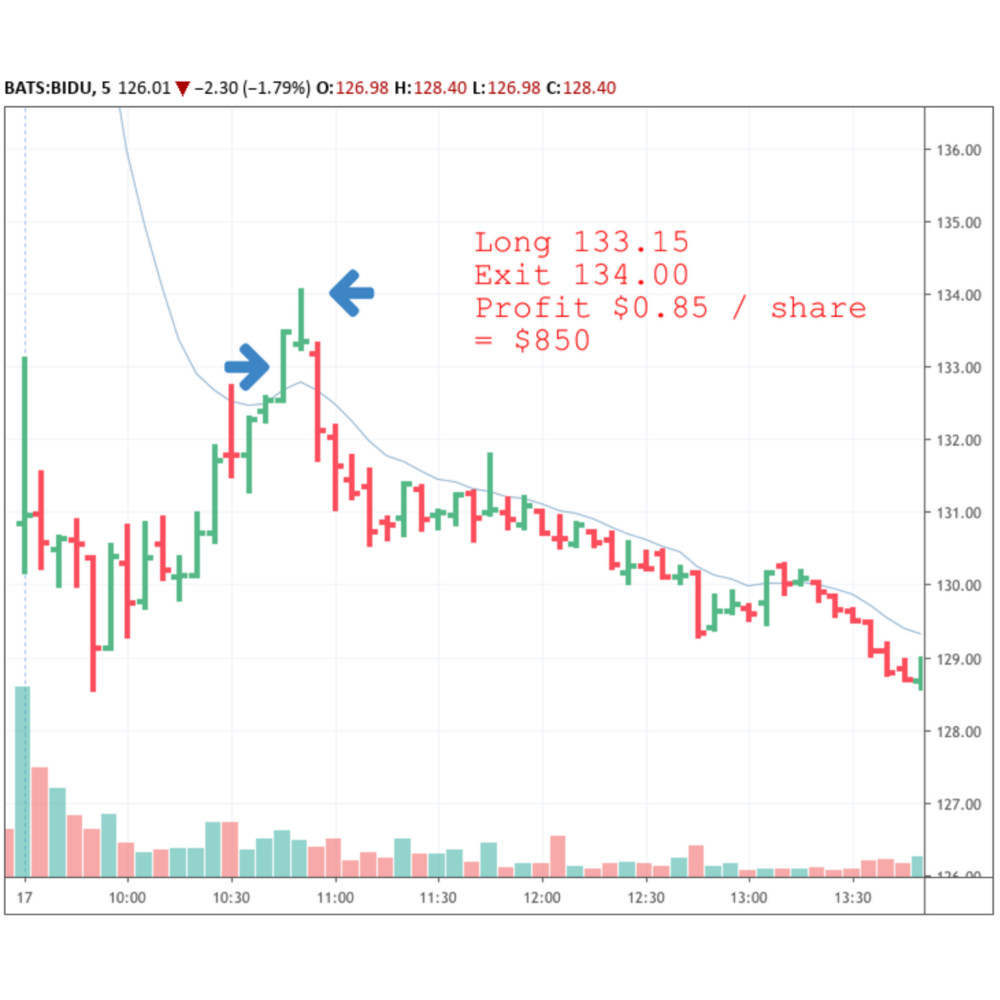

I’m just posting one chart today, because it’s a peach. This was a late trade for lazy old me, who is usually done by lunchtime, but the tech stocks were a-tumbling, and opportunity was everywhere.

There’s a certain amount of luck in trading, I’ll be honest. Or rather, a certain amount of bad luck. It can often be the case that we miss a great trade because we’re in another not so good one, or because we just didn’t have that stock on our watchlist. FB is one of my core stocks so I’m always keeping an eye on it. And because this was a late trade, I was out of everything else by the time it happened, so could give it my full attention. In other words bad luck did not afflict me, and because I was prepared I was able to capitalize on the opportunity when it came along.

As it turned out, my attention was only required for about five minutes. By then we were heading north again. A pause, or a reversal? Nobody knows, so it was time to get out.

Had I gone for the second entry about ten minutes later, I could have almost doubled my profit. Was that a mistake? Maybe. But the momentum on the second part of the move was less, and I’d made more than enough money for the day to deal with the risk.