Monday was a slightly slower day on the markets, what with many states being off for the day. But as we know, there’s always something to trade, and even if volumes were down a bit, the markets didn’t disappoint. Here’s what happened on EOG:

Continue reading “Columbus Day”Announcing Something New

Anyone following my Instagram feed will have seen a little post that was out of the ordinary on Friday. It looked like this:

Want to know why, for the first time, I didn’t post a chart? Read on — for I have something brand new to announce!

A Common Thread

There is a common thread running through my books. Okay, there are probably several threads, the main one being that I’m a lazy git. Leaving my inertia aside though, there is one thing I re-iterate in all my books, from the original How To Day Trade Stocks For Profit through to Brain Hacks For Traders.

The thread I am talking about is trade execution.

It comes up in everything I write, including this blog. I maintain that trading profitably is twenty percent about knowing what to do, and eighty percent about actually doing it. Trading is — theoretically — easy. It’s easy in the same way losing weight is easy. If we want to lose weight we know that we should eat less fat and carbs and do more exercise. Yet actually preventing ourselves from shoving delicious meals and snacks into our mouths and instead going out for a run is a whole different matter. It takes enormous reserves of willpower.

Trading is the same. We can learn the basics in a few days. It doesn’t take long to understand where prices come from and what makes them move. We can soon get to grips with the concepts of support and resistance and why they occur. Learning to read charts and spotting patterns is a simple enough matter. It’s not even that hard to put together a trading strategy, or to learn a proven strategy from someone else. Yet when it comes to putting our own hard-earned cash on the line and executing trades, things can take a turn.

Where It Gets Hard

It can be hard to enter a trade when we can’t see the future with certainty. It can be hard to run a winner to extract the maximum profit from it, when a little voice in our head is saying get out now — take the money and run. It can be tough to turn our backs on suboptimal setups. And it can be almost physically painful to exit a trade at a loss. Even when we know our loss is likely to turn into a bigger loss, we can find ourselves holding on in the desperate hope things will turn around and go our way.

I’ve written extensively about why we find executing trades perfectly so difficult, and I’ve offered solutions for all of those reasons. Brain Hacks discusses how to use our own built-in cognitive biases and learned behaviors so that they work for us rather than against us. In that book there is a simple tool I recommend. It’s essential to many of the hacks. In fact I recommend it in all of my books. That tool is a trading log, or trading journal.

A Simple Yet Powerful Tool

A trading log is not a pre-requisite to successful trading, but I can tell you now, I don’t know a single profitable trader who does not use one.

The reasons good trading logs work are numerous. Here are a few off the top of my head:

- Being able to look back and analyse our actions and see where we are making mistakes is fundamental to being able to correct those mistakes.

- The act of writing down our trading intentions — from the high level of our trading plan to individual trades as they occur — burns those intentions into our brains. It forces us to consider them properly.

- Writing down our actions prevents us from lying to ourselves. It’s easy to say “I’ll just let this one go”, but when the evidence in front of us shows us in black and white that this is already the third time we’ve let one go today, we cannot ignore it.

There are plenty more reasons to log our trades, and I won’t go into them here or I’ll find myself typing out the whole of Brain Hacks For Traders! Needless to say, logging and journalling is a critical part of successful trading.

Expending Brainpower

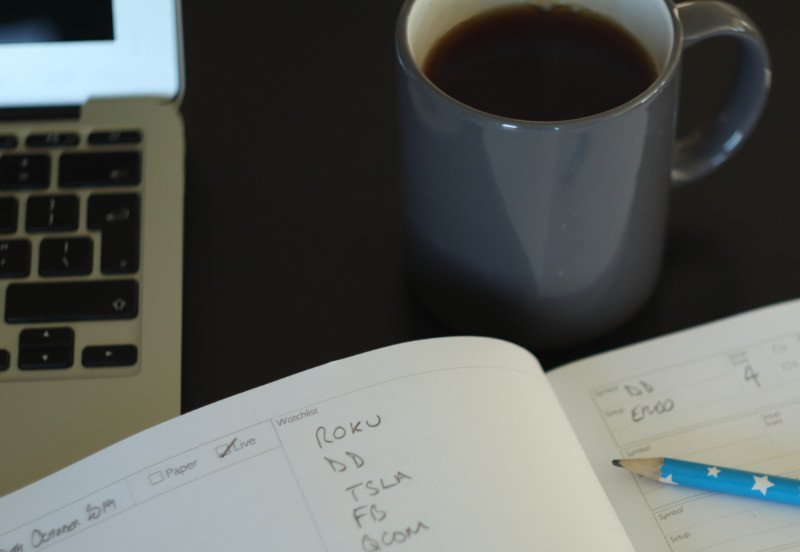

Something else I have always advocated is that a trading journal should be written longhand, i.e. with a pen or pencil rather than a keyboard. Writing long hand is cognitively expensive — it requires more neurones than using a keyboard. That’s a Good Thing because the more neurones we employ in a task, the more engaged we become with that task. It’s easy to mindlessly bash a few keys while thinking about what we’re going to have for dinner tonight. Indeed the ease with which words appear on a screen when using a keyboard explains much of the drivel that appears on this very blog.

When we write longhand, we are forced to focus on what it is we are writing (yes I know, I should write my blog posts longhand, I get it!) Memories are literally built from connections between neurones. Using more of them reinforces those connections. Putting pen to paper then, is an almost magical process. It enforces clarity of thought, and it builds a memory of what we are writing. Again, all the successful traders I know keep written records — and by written I mean written in their own hand.

Logging, Evolved

Over the years I’ve been trading, I’ve evolved my trade logging style. I have incorporated ideas from other successful traders. I’ve tweaked and improved it to come up with a format that is both fast to use and highly efficient.

It’s important to log our trades in a pre-determined format because it makes it simple to go back and analyse them later. When I see a setup come along that I think I’m likely to take, I write it down in my log, and crucially I score it. (Note: if you don’t know about scoring setups and execution, please read Brain Hacks For Traders; in my view, scoring is essential). I note a few important details about my entry and exit, and most importantly about my execution. I do this for every trade, and I do it in a fixed format that means I can get everything down in seconds.

My trading journal isn’t just about recording trades. It’s also a place where I keep my daily watchlist, where I note important data like upcoming economic calendar events, and where I set out personal goals. In short, my journal is the very heart of my personal trading operation.

Which is why, when my publisher suggested I make it available to all, I jumped at the chance.

Introducing The Official Harvey Walsh Trading Journal

Putting together my trading journal format took years of evolution. Now anyone can use that format for themselves. My Journal is a large 8.5 x 11″ book pre-printed with enough pages to trade every day of the working week for a full three months.

The heart of the Journal is the logging section. 120 double pages are laid out to let you record all your pre-market and post-market activities on one side, and all your trades on the other. This is the exact same format I use to trade each day. It makes it super simple to go back and analyse your performance and see what you are doing right and what you are doing wrong.

I’ve also included a free-form section at the start in which to write your trading plan, draw out any model setups you want, and to include some NLP affirmations (again, please refer to Brain Hacks if any of this is new to you).

Core to the Journal is my simple system for setup and execution scoring, and goal and reward setting. If you’ve read the section on gamification of trading in Brain Hacks, you’ll know all about the positive benefits of the system. And if you haven’t, there’s a quick primer included in the introductory pages of the Journal.

A Partnership

I’m truly delighted with this new book. It’s not like any of my others, because this book is a partnership. It’s a partnership between me and the other traders who helped me evolve my logging system over the years. But more importantly it’s a partnership between you and me — because I’m giving you a tool that you can take away and use how you want in order to improve your own trading and become more profitable.

The Official Harvey Walsh Trading Journal is available today from Amazon and other good bookshops.

Some Bread and Butter

Over the past few weeks I’ve been guilty of posting the bigger winners of the day. Four-figure wins garner more attention and apparently it’s what people like to see, so I feel mostly justified in favouring them here. But it’s important to remember that the bread and butter of the business is the regular smaller trades that come along day after day. Trades like this one:

Continue reading “Some Bread and Butter”Managing Multiple Trades

Well that was a busy morning. It all kicked off at the same time, leaving me with a couple of trades to manage at once. One of the reasons I only trade the morning session is because I am not blessed with great intelligence or brainpower, so I have to try to use what little I have as best I can. I’m fresher and more alert at the start of the session, so am better able to juggle a couple of trades at once. Here’s the first of two trades I was running concurrently:

Continue reading “Managing Multiple Trades”Downs and Ups

Here are a couple of trades to kick off the brand new week — one in each direction. The first one was old friend ROKU:

Continue reading “Downs and Ups”Trade, 4th October 2019

Here’s a quick TSLA trade to round out the week:

A regular pattern with a clear entry. I didn’t like that MA much, but we play the hand we are dealt sometimes. Everything else was good. I had 229 in mind as a target, so when it first failed to reach it I was out with just over a grand in the bank. As it happens, the price did eventually reach there, but had I waited for that to happen I would have been shaken out for a much smaller win beforehand. Knowing TSLA, it was better to take the money and run.

A Big Loss

As regular readers and readers of my books know, I like to keep my losses small. Really small. A few cents maximum. If a trade doesn’t work out, I’m outta there sharpish. Which is why today’s losing trade was a bit painful, because it went further than a few cents against me. It was all my fault.

But I’m getting ahead of myself. First, here’s what happened with AMD:

Continue reading “A Big Loss”Going Old School

To make a change from posting so many NASDAQ tech stocks, here are a couple of old school financial ones traded on the NYSE. First off, WFC:

Continue reading “Going Old School”A TSLA Short Goes Long

Just one trade to post today, because I’m in a hurry and because it’s a good’un. Here’s Tesla (again):

Core Confidence

The other day I mentioned that I had missed an early entry on a trade. It was a bad day and that was a bad start. For my first trade today I took the earlier entry, and there was a good reason for it. Here’s MU:

Continue reading “Core Confidence”