It was the best of times it was the worst of times. Nope, who am I kidding, this isn’t going to work. I’m posting two trades today, and neither represent either the best or the worst of times. But they do show something else quite interesting. They handily illustrate that whether we have a large or small trading account, there are similar opportunities out there.

First, let’s have a look at the quicker, more profitable, and more ‘expensive’ trade. Here’s PANW:

This was quite a late entry for me, coming at around 11am. The setup was not the best, but the stock was clearly weak, making lowing highs and lower lows. Trading is about weighing up the evidence the price is presenting and evaluating the risk of taking a long or a short position. Setups and patterns are just pre-evaluated forms of evidence. Taken individually they don’t mean much, but combined they have power. So although the setup was less than perfect, the other factors on and off the chart combined to tip the balance in favour of taking this short. The reward was almost two thousand dollars profit made in a shade over ten minutes.

Anyone trading through or after lunch could potentially have made as much again on the bounce. Not something my strategy trades, but there was plenty of opportunity for someone who does take that sort of thing.

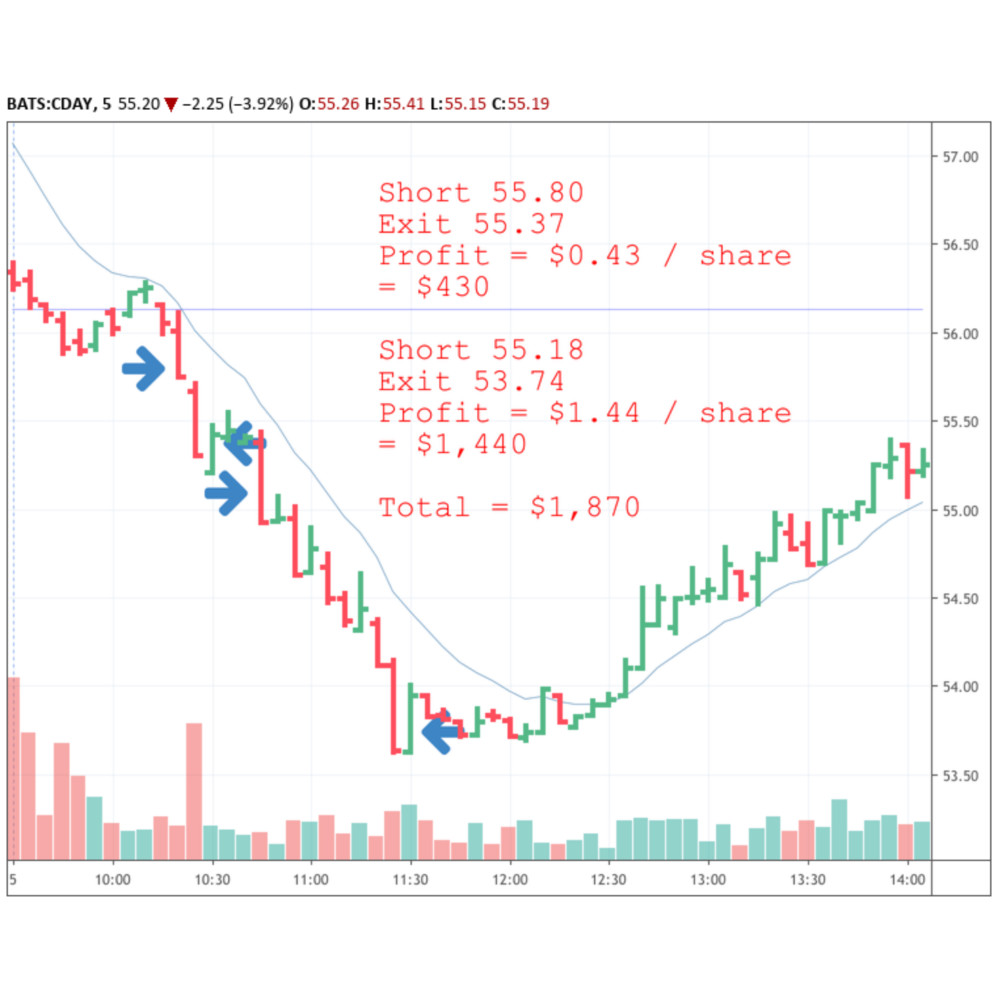

Okay, next up a two-biter. This was CDAY:

Another trade to short side. I don’t have a preference for shorts, honest. It just happens to be the case that a lot of the good trades recently are in the southerly direction!

Anyway, this was a fairly calm start, with a sudden drop in price. My entry was late (slippage), and my exit was probably a bit late too as there was a quick bounce. I was out with $430. But the bounce failed to turn into much more, and weakness prevailed. When it started heading down again, it was worth taking a second shot. With a few hundred dollars already banked, I felt comfortable holding this for much longer than I would usually hold any single trade. Although volume was nothing like what it was in the first move, the price obviously didn’t want to recover until 11:30 when at last it made some kind of decent effort to rise. I’d already gone through a couple of targets, so it was time to get out.

CDAY then, made a total of $1,870 for the two trades. In percentage terms, given the price of the stock, it was way more profitable than PANW — almost four times as profitable. But who cares about percentages? We can’t pay our bills with percentage returns. We can’t splash out on a new car with a percentage. We need dollars, and despite one of these trades offering four times the percentage return of the other, they both came up with an almost identical dollar amount.

Whether we have a budget for a $50 stock or a $200 stock, we can find opportunities that offer similar sized profits. Aren’t the markets wonderful?